Employer

Calculation of severance payment (SP)/ long service payment (LSP)

Employees whose employment commences before the transition date

Employee's SP/LSP will be divided into pre-transition portion and post-transition portion, with the calculations as below:

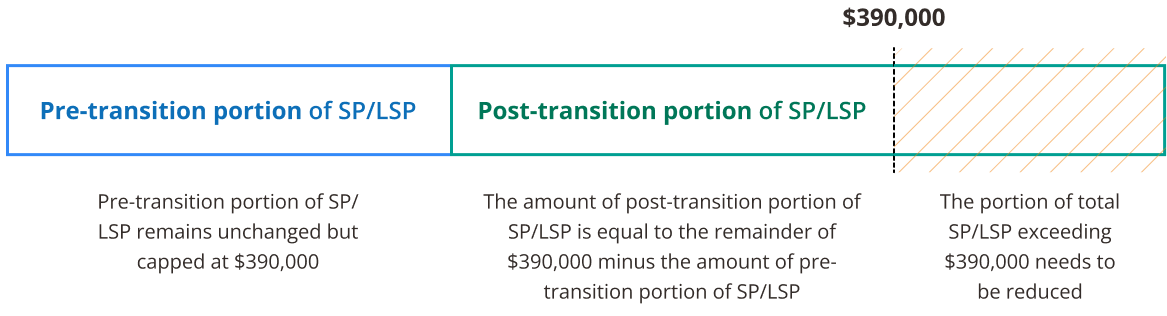

In the circumstance when the total SP/LSP exceeds $390,000

According to the Employment Ordinance, the existing maximum amount of SP/LSP is $390,000. After the abolition of MPF offsetting arrangement, the maximum amount of SP/LSP remains unchanged. If an employee's total SP/LSP (i.e. the sum of pre- and post-transition portion of SP/LSP) exceeds $390,000, the amount in excess will be deducted from the post-transition portion (i.e. the amount of post-transition portion of SP/LSP should be equal to the remainder of $390,000 minus the amount of pre-transition portion of SP/LSP).

Employees whose employment commences on or after the transition date

The calculation and cap of SP/LSP under existing provisions in the Employment Ordinance remain unchanged: